Navigating the world of pet insurance can be as tricky as teaching an old dog new tricks. But understanding what factors lead to lower premiums can save pet owners a bundle. They’ll want to know the ins and outs of scoring affordable coverage for their furry friends.

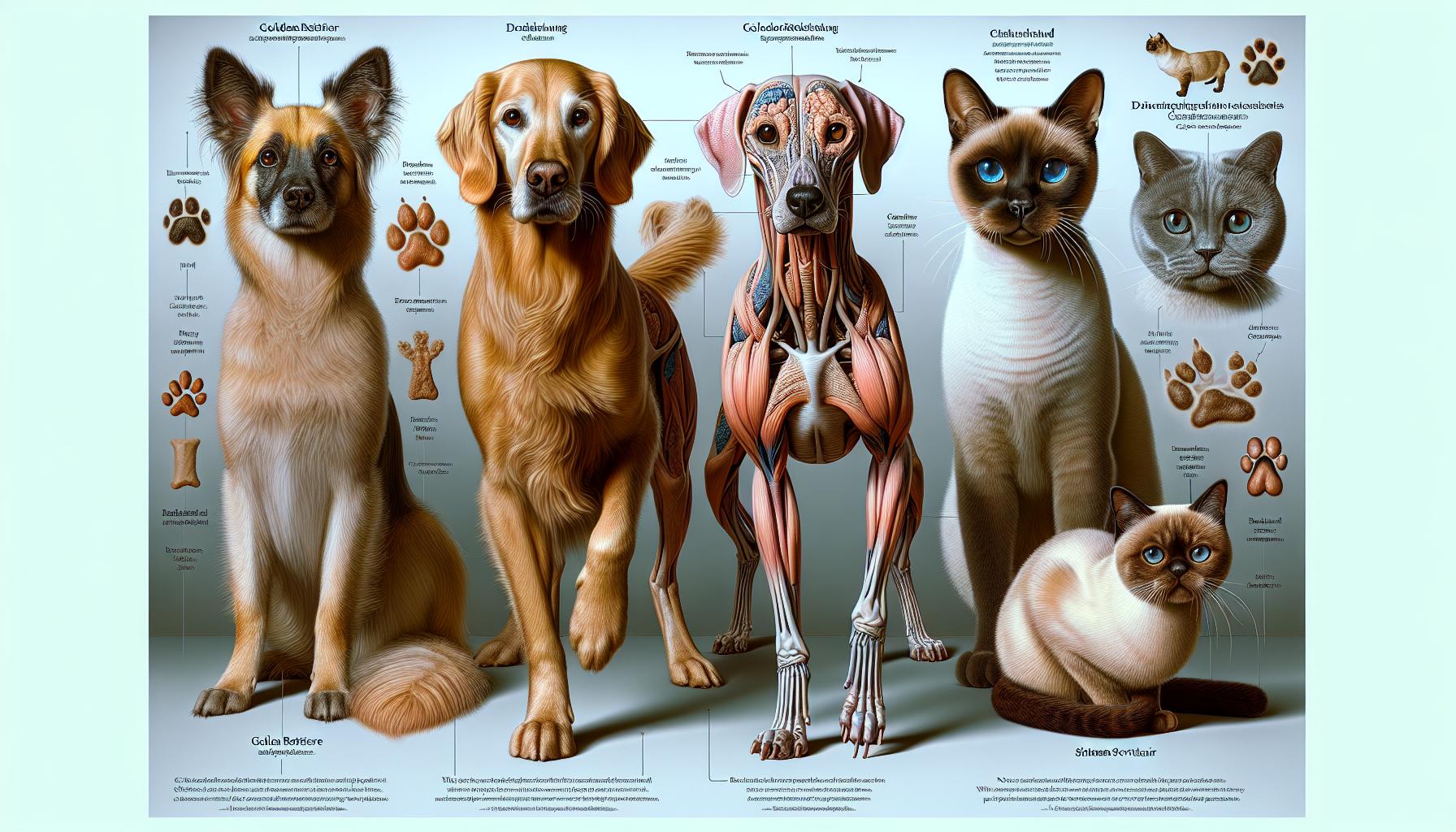

Age, breed, and health status play pivotal roles in determining pet insurance costs. Younger pets typically snag lower rates, while certain breeds may come with higher premiums due to genetic health risks. Knowing these details helps pet owners make informed decisions when shopping for insurance.

Preventative care and routine check-ups aren’t just for keeping pets healthy—they can also lead to cheaper insurance. Insurers often reward those who take proactive steps in managing their pet’s health, translating to more savings and peace of mind for the owner.

Age, Breed, and Health Status: Key Factors in Pet Insurance Costs

When exploring the intricacies of pet insurance, understanding the role of age, breed, and health status is crucial. These elements are at the core of determining policy costs and can significantly influence monthly premiums.

Age serves as a double-edged sword in the pet insurance world. Generally, insurers offer more competitive rates for younger pets, primarily because they pose a lower risk for illnesses compared to their older counterparts. Puppies and kittens, being a bundle of energy and good health, often qualify for the most affordable policies. However, it’s essential to note that enrolling pets in insurance plans at a young age can lead to long-term savings, as rates tend to lock in and exclude pre-existing conditions that might develop later.

Moving onto breed, some are predisposed to genetic health issues, making certain dog or cat breeds more expensive to insure. For instance, larger dog breeds like Great Danes or Saint Bernards often have higher premiums due to their susceptibility to hip dysplasia and other size-related ailments. Likewise, breeds prone to hereditary disorders, such as Persian cats that can face kidney and respiratory problems, will see increased insurance costs.

Finally, health status has an immediate impact on insurance pricing. Pets with pre-existing conditions or chronic illnesses are typically more costly to insure due to the anticipated need for ongoing treatment. That’s why regular preventative care and early diagnosis play integral roles in keeping insurance rates lower for pet owners. Keeping detailed health records and being proactive about pets’ health can help circumvent substantial increases in insurance premiums.

Pet owners should weigh these core factors when seeking cost-effective pet insurance options. By doing so, they can tailor insurance choices that align with their pets’ unique needs and secure financial protection against unexpected veterinary costs.

Understanding the Importance of Proactive Care for Cheaper Insurance

Taking a proactive approach to a pet’s health care can lead to more affordable pet insurance rates. Insurance providers often assess a pet’s risk profile when determining premiums; pets that pose a lower risk typically enjoy lower insurance costs. Proactive care includes regular veterinary checkups, vaccinations, and preventative treatments, which can reduce the likelihood of serious health issues developing over time.

Pet owners who invest in routine care and preventative measures are less likely to file insurance claims for preventable conditions, which in turn, may lead to reduced rates or discounts from their insurance provider. Moreover, certain insurance plans offer wellness coverage options that may partially offset the costs of proactive care. By comparing these plans, pet owners can find the right balance between coverage and out-of-pocket expenses for routine care.

Maintaining a healthy lifestyle for pets is another aspect of proactive care. This consists of:

- Ensuring a balanced diet

- Regular exercise

- Weight management

- Dental hygiene

These practices not only contribute to a pet’s overall well-being but they’re also looked upon favorably by insurers when pricing policies. Pets that stay within a healthy weight range tend to have fewer health problems, which relates directly to fewer claims and thus potentially cheaper insurance premiums.

Insurance companies often utilize pet health data and claim histories to determine the level of risk associated with insuring a particular pet. Pet owners who can demonstrate a commitment to proactive care may have an advantage when negotiating premiums.

Records of consistent, routine care indicate a responsible pet owner who is less likely to need unexpected and costly veterinary services. Pets that are up-to-date on vaccinations and receive yearly wellness exams are less likely to encounter unforeseen illnesses, translating into fewer surprises for both the owner and the insurance company.

Ultimately, proactive care is not only beneficial for the pet’s health but is also a strategic move for pet owners looking to manage insurance expenses.

The Benefits of Routine Check-ups and Preventative Care

Routine check-ups and preventative care are vital components in managing pet health and controlling insurance costs. Regular veterinary visits provide an opportunity for early detection of diseases, which can often be treated more effectively and affordably when diagnosed at an early stage. These check-ups typically involve physical examinations, updating vaccinations, and screenings for common ailments.

Preventative care extends beyond the vet’s office. It includes administering heartworm prevention, flea and tick treatments, and dental care. These measures are not just beneficial for the pet’s overall well-being; they also play a significant role in the financial aspect of pet ownership. Insurance companies recognize the value of preventative strategies and typically reward pet owners who follow through with these practices with lower insurance premiums. This is because such proactive measures reduce the risk of future claims.

Pets with up-to-date vaccinations and a clean bill of health pose a lower insurance risk. This translates to more favorable rates for their owners. Pet insurance providers may offer various discounts or rewards programs for owners who regularly take their pets for check-ups and keep up with preventative treatments. Moreover, maintaining these health practices demonstrates to insurers that the pet owner is invested in their pet’s health, further incentivizing companies to offer competitive pricing.

| Insurance Benefit | Requirement |

|---|---|

| Lower Premiums | Regular Check-ups |

| Reduced Claim Likelihood | Up-to-date Vaccinations |

| Discounts or Rewards | Preventative Treatments |

Pet owners can potentially unlock additional savings by bundling multiple pets under one policy or by choosing higher deductibles, which often results in lower monthly or annual premiums. However, these options should be balanced with the potential out-of-pocket expenses that an owner is willing and able to cover. Therefore, engaging in routine check-ups and preventative care is not simply about ensuring a pet’s health; it’s about making strategic choices that impact the long-term financial commitments of pet ownership.

How Younger Pets Snag Lower Insurance Rates

When it comes to pet insurance premiums, age is a crucial determining factor. Younger pets typically snag lower insurance rates for a simple yet compelling reason: they often pose a lower risk for insurers. Younger animals are generally healthier and less likely to suffer from chronic health conditions that can rack up veterinary bills over time. Because of this, insurance companies are more inclined to offer more competitive rates to the owners of youthful pets.

Just as with humans, animals age and develop health issues over time. When pet owners invest in insurance during their pet’s younger years, they’re essentially opting in at a time when their pets are at a lower risk for health concerns that require expensive treatments or surgeries. The likelihood of filing a claim is smaller, and this is reflected in the lower premiums charged by insurance providers.

Adjusting Insurance Plans as Pets Age

As pets get older, their healthcare needs can change dramatically:

- Wellness exams may be required more frequently

- There’s an increased possibility for chronic diseases

- Age-related issues like arthritis or diabetes may arise

Recognizing these potential issues, pet owners should understand the importance of early enrollment. Enrolling pets in insurance plans while they’re still young can lead to significant savings. It locks in rates that are determined by the age of the pet at the time of policy initiation. Additionally, doing so avoids exclusions on coverage for pre-existing conditions that might arise if the owner waits to get coverage until the pet’s senior years.

Moreover, pet owners can often secure coverage for breed-specific conditions early on. For example, certain breeds are prone to hip dysplasia; getting insurance before this has a chance to become a diagnosed condition can mean the difference between having it covered or paying out-of-pocket.

When these strategies are employed early on, pet owners are in a better position to manage their pets’ wellness throughout their lives while keeping insurance premiums at a minimum.

Certain Breeds and Genetic Health Risks: Factors That Influence Premiums

When considering pet insurance, breed-specific risks play a pivotal role in the determination of premiums. Insurance providers are well-versed in the predispositions of certain breeds to genetic conditions and illnesses. For instance, large dog breeds like Great Danes may be predisposed to hip dysplasia, while Bulldogs often suffer from respiratory issues. These inherent health risks make insuring such breeds more costly.

Cats are not immune to this pricing strategy, with breeds like the Sphinx known for skin conditions and the Maine Coon for its potential heart problems. Not all breeds face the same level of risk; premiums are adjusted according to the likelihood of a breed developing a hereditary condition.

| Breed | Common Health Risk | Potential Impact on Premiums |

|---|---|---|

| Great Dane | Hip Dysplasia | Higher Premium |

| Bulldog | Respiratory Issues | Higher Premium |

| Sphinx Cat | Skin Conditions | Higher Premium |

| Maine Coon Cat | Heart Problems | Higher Premium |

Pet insurance companies often require detailed vet check-ups before finalizing a quote to assess the pet’s current health status. The age of the pet at the time of these exams can also influence the premiums, with pre-existing conditions being a notable factor in the final cost. By analyzing a pet’s breed alongside health screenings, insurers can provide tailored plans that reflect the pet’s risk profile.

However, not all is set in stone. Some insurers offer wellness plans that contribute to preventing breed-specific illnesses. Such preventative measures can be considered investments in the pet’s health, potentially offsetting future costs linked to genetic diseases.

Ultimately, pet owners should be mindful that while certain breeds may incur higher premiums due to genetic health risks, shopping around and comparing different insurance plans can help find the one that suits their pet’s specific needs and mitigates the financial risks associated with their beloved pet’s breed.

Conclusion

Pet insurance premiums are directly tied to breed-specific risks. Understanding these factors empowers pet owners to make informed decisions when selecting a policy. It’s essential to weigh the potential health risks associated with one’s pet against the cost of coverage. Shopping around for a plan that aligns with your pet’s unique needs can lead to substantial savings while ensuring they’re protected. Remember, the right insurance is out there—it just takes a bit of research to find the perfect fit.

Frequently Asked Questions

What factors influence pet insurance premiums?

Pet insurance premiums are influenced by a variety of factors including the pet’s age, breed, health history, and the level of coverage selected. Breed-specific risks are a significant factor as some breeds are more prone to genetic conditions and illnesses.

Why are some pet insurance plans more expensive for certain breeds?

Some breeds are at a higher risk of developing hereditary conditions, which could result in more frequent or costly veterinary visits. Insurance providers consider these risks when setting their premiums, often leading to higher costs for these breeds to offset potential claims.

How can I find the right insurance for my pet’s breed?

Shop around and compare different insurance plans. Look for policies that offer coverage for breed-specific conditions and compare the prices and terms offered by various insurers. Consider customer reviews and the company’s reputation for claims handling.

What should I consider when choosing a pet insurance plan?

Consider the following:

- The level of coverage provided.

- Whether the policy includes breed-specific conditions.

- The deductible and reimbursement levels.

- Exclusions and limits.

- The insurer’s reputation and customer service record.

Always read the fine print carefully before deciding.

Can I reduce the cost of my pet’s insurance if it belongs to a high-risk breed?

You might be able to reduce costs by:

- Choosing a higher deductible.

- Opting for a lower reimbursement percentage.

- Looking for discounts (e.g., multi-pet discounts).

- Maintaining your pet’s health through regular vet visits and preventative care.

- Comparing policies to find the most cost-effective option for your needs.